Know Your Pan | Know your Pan with your name and date of birth | How to find Pan Number | Permanent Account Number | https://incometaxindiaefiling.gov.in

Know Your Pan | Know your Pan with your name and date of birth | How to find Pan Number | Permanent Account Number | https://incometaxindiaefiling.gov.in

Permanent Account Number is nothing but 10 digits Alphanumeric unique identification number for issued by the Income Tax Department for proper administration of income tax database and for other purposes.

It contains first five alphabets then next four are numbers and the last one is an alphabet. The details of the applicant of the PAN are stored at the database of Income Tax Department.

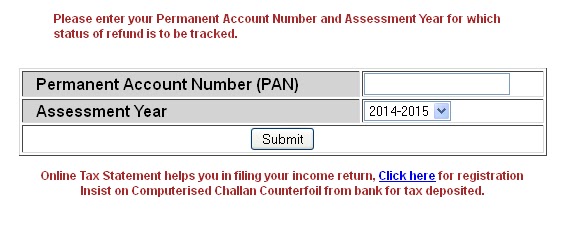

It is frequently happened that PAN was applied and allotted many years before and the PAN holder did not remember the Permanent Account Number. It also be happened that PAN card holder lost his PAN card and he/she want to know that the spelling of his name, father’s name, surname, jurisdiction etc… which was applied originally at the first time. Or for any reason if PAN holder want to know his PAN details then he/she has to go to the following link.

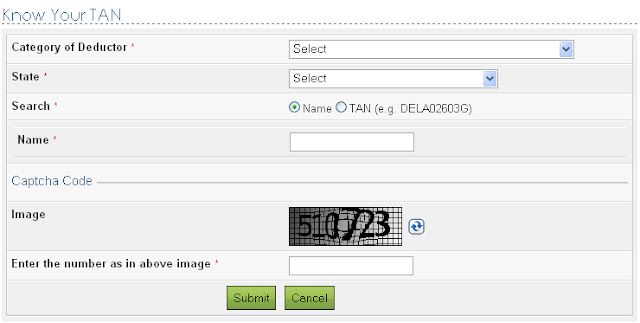

After reaching the above link you just required the following details to know your PAN (P.A. Number)

- Date of Birth / Date of incorporation

- Surname

- Middle name

- First name

The mandatory or minimum requirement to know your pan details is the correct Date of Birth and correct spelling of your surname.

In most of the cases you get your PAN details with the help of the above details, but sometimes it requires further following details

- Father’s First Name

- Father’s Middle Name

- Father’s Surname

Important: Many it could be possible that you cannot find the Permanent Account Number (PAN) even though you fill the above details. The reason is the correct spelling of the above details could not match with data of the income tax department.

To know your pan it is compulsory to match your data with it the data of income tax department

In case of company, partnership firm, HUF etc the name of the entity should be typed in the Surname column and the DOB would be Date of incorporation of the respective entity.

If you have correct information which are printed on the pan card than just fill the details and you can get you PA Number (PAN).

If you still could not know your pan details, then it may happen that the spelling of your name, father’s name or surname may be different at the Income Tax Department.

Must Take Care:

- While typing the details you should type the data as given to income tax department at the time of filling PAN card form

- While typing the text should not contain space between any alphabetical before the text, between the texts or after the text. E.g. (_ashish) before, (ash_ish) between, (ashish_) after the name/father’s name/surname

- DOB should be with DD-MM-YYYY format. The separator should be ( - ) and not like ( / ), ( . ), ( , ) or blank.

Know Your Pan | Know your Pan with your name and date of birth | How to find Pan Number | Permanent Account Number | https://incometaxindiaefiling.gov.in